Predicting the Price of Gas in 2025: A Complex Equation

The price of gasoline, a vital component of our daily lives, is a constantly fluctuating variable. It’s influenced by a complex web of factors, making predicting its future trajectory a daunting task. However, understanding the key drivers and analyzing historical trends can provide valuable insights into what the gas price might look like in 2025.

Factors Influencing Gas Prices

The price of gasoline is a reflection of the global energy market, subject to a multitude of influences, including:

- Crude Oil Prices: This is the most significant factor. Oil is the raw material for gasoline, and its price directly impacts the final cost. Global supply and demand, geopolitical events, and production costs all influence crude oil prices.

- Refining Costs: The process of transforming crude oil into gasoline requires energy and resources, adding to the final cost. These costs include labor, equipment, and environmental regulations.

- Distribution and Transportation: Getting gasoline from refineries to gas stations involves transportation, storage, and distribution, each adding its own cost component.

- Taxes and Regulations: Governments impose taxes on gasoline, and various regulations, such as environmental standards, affect production costs.

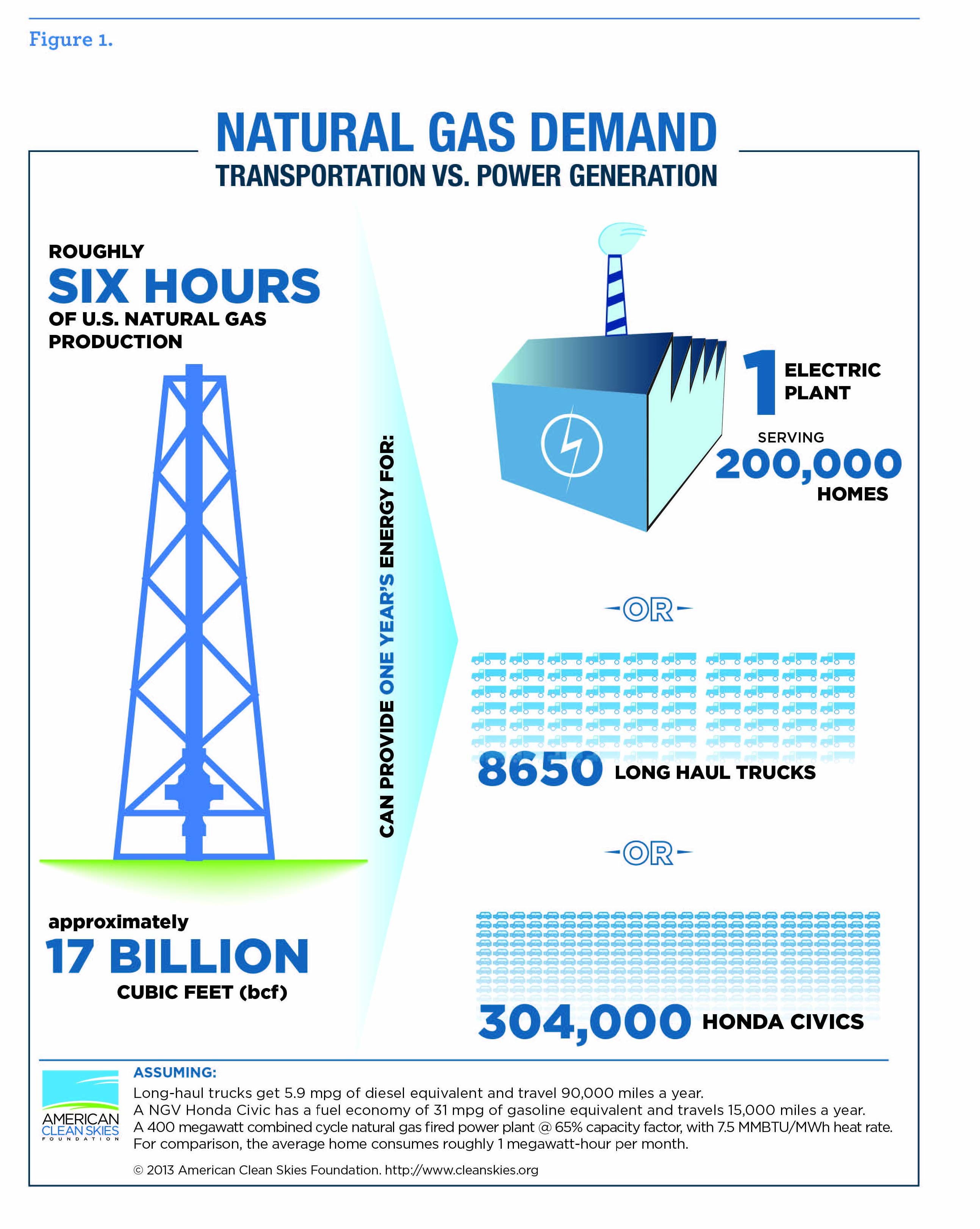

- Demand: Consumer demand for gasoline is influenced by factors like economic activity, vehicle efficiency, and alternative transportation options.

- Seasonal Variations: Gas prices typically rise during the summer driving season due to increased demand and seasonal maintenance shutdowns at refineries.

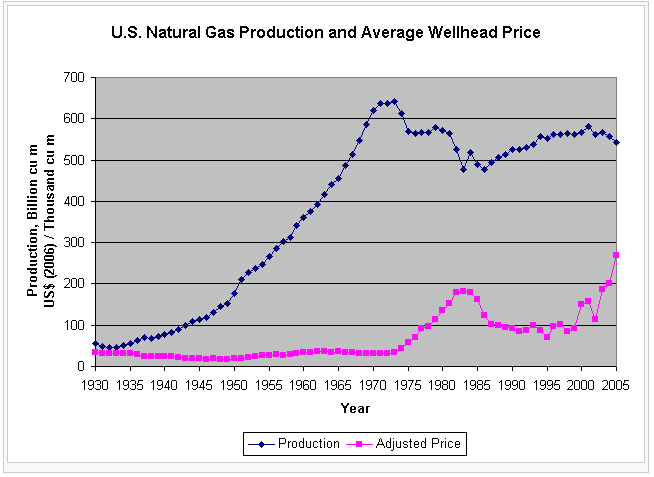

Historical Trends and Projections

Analyzing historical trends can offer insights into potential future price movements. Over the past few decades, the price of gasoline has exhibited significant volatility, influenced by factors like:

- Global Economic Fluctuations: Recessions and economic downturns tend to reduce demand, leading to lower gas prices. Conversely, economic growth often drives demand and increases prices.

- Geopolitical Events: Wars, political instability, and sanctions can disrupt oil production and supply chains, resulting in price spikes.

- Technological Advancements: Improvements in vehicle efficiency and the development of alternative fuels like electric vehicles can impact gasoline demand.

- Climate Change Policies: Regulations aimed at reducing carbon emissions, such as carbon taxes, can affect the cost of gasoline production.

Predicting the Future: A Balancing Act

Predicting the price of gas in 2025 involves considering various factors and their potential impact:

1. Crude Oil Prices:

- Supply and Demand: The International Energy Agency (IEA) forecasts a gradual increase in global oil demand over the next few years. However, production growth is expected to be slower, potentially leading to tighter supply conditions and higher prices.

- Geopolitical Risks: The ongoing conflict in Ukraine, tensions in the Middle East, and the potential for sanctions on oil-producing countries pose significant risks to oil supply stability and could lead to price volatility.

- Renewable Energy Transition: The shift towards renewable energy sources, such as solar and wind power, could gradually reduce demand for oil, potentially putting downward pressure on prices in the long term.

2. Refining Costs:

- Inflation and Energy Costs: Inflation and rising energy costs for refining operations are likely to increase refining costs, pushing up gasoline prices.

- Environmental Regulations: Stricter environmental regulations and carbon pricing mechanisms could further increase refining costs.

3. Distribution and Transportation:

- Supply Chain Disruptions: Global supply chain disruptions, exacerbated by geopolitical tensions and the COVID-19 pandemic, could impact the cost of transporting gasoline.

- Infrastructure Investment: Investments in infrastructure, such as pipelines and storage facilities, could improve efficiency and potentially lower transportation costs.

4. Taxes and Regulations:

- Carbon Pricing: Governments are increasingly implementing carbon pricing mechanisms, such as carbon taxes and cap-and-trade systems, which could lead to higher gasoline prices.

- Fuel Efficiency Standards: Stricter fuel efficiency standards for vehicles could reduce gasoline demand, potentially moderating price increases.

5. Demand:

- Economic Growth: Global economic growth, particularly in emerging markets, is expected to drive demand for gasoline.

- Electric Vehicle Adoption: The growing popularity of electric vehicles could gradually reduce gasoline demand, potentially putting downward pressure on prices in the long term.

- Alternative Transportation: The development of alternative transportation options, such as public transportation and ride-sharing, could also impact gasoline demand.

Scenarios for 2025:

Based on the factors discussed above, several scenarios for gas prices in 2025 are possible:

Scenario 1: Moderate Price Increase:

- Crude oil prices rise moderately due to increased demand and supply constraints.

- Refining costs increase due to inflation and environmental regulations.

- Demand for gasoline remains relatively strong due to economic growth and limited electric vehicle adoption.

- Gas Price: A moderate increase, potentially reaching $4 per gallon or higher in some regions.

Scenario 2: Significant Price Increase:

- Geopolitical events, such as a major conflict or sanctions on oil-producing countries, disrupt supply chains and lead to a sharp increase in oil prices.

- Refining costs rise significantly due to high energy prices and environmental regulations.

- Demand for gasoline remains high, further pushing prices up.

- Gas Price: A substantial increase, potentially exceeding $5 per gallon in some regions.

Scenario 3: Moderate Price Stability:

- Crude oil prices stabilize or decline slightly due to increased production and a slowdown in economic growth.

- Refining costs remain relatively stable, but may be influenced by environmental regulations.

- Demand for gasoline moderates due to increased electric vehicle adoption and alternative transportation options.

- Gas Price: A relatively stable price, potentially hovering around $3 per gallon in some regions.

Conclusion:

Predicting the price of gas in 2025 is a complex exercise, influenced by a multitude of factors. While the factors mentioned above provide a framework for analysis, the future is inherently uncertain.

The price of gasoline will likely continue to fluctuate, driven by global economic conditions, geopolitical events, and technological advancements. It is crucial to stay informed about these factors and their potential impact on the energy market.

Ultimately, the price of gasoline will reflect the balance between supply and demand, influenced by a complex interplay of economic, political, and technological forces. The future of gas prices will depend on how these forces play out over the next few years.