Navigating the Road Ahead: A Deep Dive into 2025 BMW X5 Interest Rates

The 2025 BMW X5, a beacon of luxury and performance, promises an exhilarating driving experience. But before you hit the gas, it’s crucial to understand the financial landscape surrounding your purchase. Interest rates, a critical factor in determining your monthly payments and overall cost, can significantly impact your decision.

This comprehensive guide delves into the complex world of 2025 BMW X5 interest rates, equipping you with the knowledge to make informed financial choices. We’ll explore the key factors influencing rates, dissect current trends, and offer practical strategies to secure the best possible deal.

Understanding the Interest Rate Landscape

Interest rates are essentially the cost of borrowing money. When you finance a BMW X5, you’re essentially taking out a loan, and the interest rate represents the price you pay for using that money. Lower rates mean lower monthly payments and a more affordable purchase.

Factors Shaping Interest Rates

Several factors intertwine to determine the interest rate you’ll receive on your 2025 BMW X5 loan:

- Credit Score: Your credit score is the cornerstone of any loan application. A higher credit score (above 740) indicates financial responsibility and opens the door to lower interest rates. Conversely, a lower score (below 670) can lead to higher rates or even loan rejection.

- Loan Term: The length of your loan, typically ranging from 3 to 7 years, influences your interest rate. Longer terms generally come with higher rates, as the lender is exposed to greater risk over a longer period.

- Loan Amount: The amount you borrow directly impacts your interest rate. Larger loan amounts often attract higher rates due to the increased risk for the lender.

- Current Market Conditions: Interest rates are influenced by broader economic factors like inflation, monetary policy, and overall economic stability. When inflation rises, central banks may raise interest rates to curb spending, potentially impacting auto loan rates.

- Vehicle Type and Model: Luxury vehicles like the BMW X5 are often associated with higher interest rates compared to more affordable models. This is due to the perceived higher risk of default by lenders.

- Down Payment: A larger down payment reduces the loan amount, making you a less risky borrower and potentially securing a lower interest rate.

- Dealer Incentives: Dealerships may offer special financing options, including subsidized interest rates, to incentivize sales. These offers can be particularly attractive for new models like the 2025 BMW X5.

Current Trends in Auto Loan Rates

The auto loan landscape is constantly evolving. In recent years, interest rates have seen significant fluctuations due to economic instability and rising inflation.

- Rising Interest Rates: As of late 2023, average auto loan interest rates have been on an upward trajectory, driven by the Federal Reserve’s efforts to combat inflation. This trend is likely to continue into 2025, potentially impacting the cost of financing your 2025 BMW X5.

- Impact of Inflation: High inflation erodes the value of money, leading lenders to demand higher interest rates to compensate for the risk of losing purchasing power over time.

- Competition among Lenders: Despite rising rates, competition among lenders remains fierce. This can work in your favor, as banks and credit unions often offer competitive rates to attract borrowers.

Strategies for Securing Favorable Interest Rates

While interest rates are influenced by external factors, you can still take proactive steps to secure the best possible deal:

- Boost Your Credit Score: Focus on improving your credit score before applying for a loan. Pay bills on time, keep credit utilization low, and avoid opening unnecessary credit accounts.

- Shop Around for Rates: Don’t settle for the first offer. Compare rates from multiple lenders, including banks, credit unions, and online lenders.

- Consider a Shorter Loan Term: While a shorter term might lead to higher monthly payments, it can significantly reduce your overall interest costs.

- Negotiate with the Dealer: Don’t be afraid to negotiate with the dealership for a lower interest rate. They often have flexibility in offering competitive financing options.

- Explore Dealer Incentives: Stay informed about any dealer incentives or special financing programs for the 2025 BMW X5. These can provide significant savings.

- Consider a Trade-in: Trading in your current vehicle can reduce the loan amount, potentially leading to a lower interest rate.

- Pre-Approval: Getting pre-approved for a loan from a bank or credit union before visiting the dealership gives you leverage in negotiations.

Navigating the Financial Journey

Financing a 2025 BMW X5 requires careful planning and a thorough understanding of the interest rate landscape. By following these strategies and staying informed about current trends, you can increase your chances of securing a favorable interest rate and driving your dream car with confidence.

Beyond the Interest Rate: Other Financial Considerations

While interest rates are a crucial factor, they are not the only financial aspect to consider when purchasing a 2025 BMW X5.

- Vehicle Price: The sticker price of the BMW X5 will be a significant factor in your overall financing cost. Research different trim levels and features to find the best value for your budget.

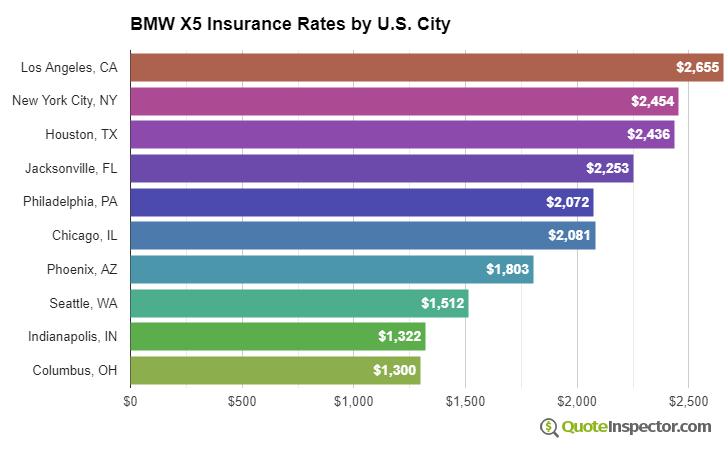

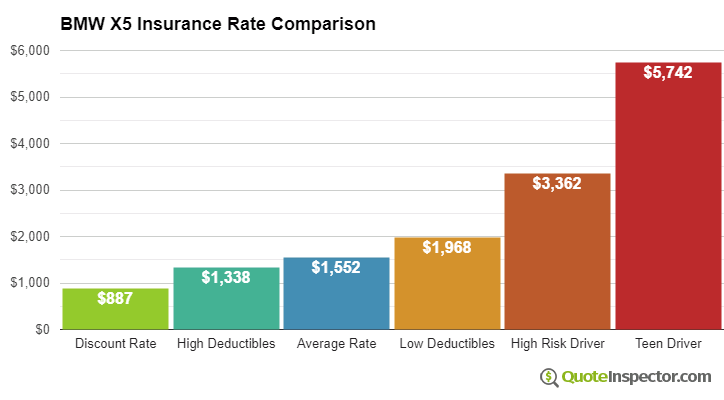

- Insurance Costs: Luxury vehicles like the BMW X5 often come with higher insurance premiums due to their value and performance. Factor these costs into your budget.

- Maintenance Expenses: Luxury cars require regular maintenance, which can be expensive. Plan for potential maintenance costs in your budget.

- Fuel Efficiency: Consider the fuel economy of the 2025 BMW X5, as gas prices can significantly impact your overall ownership cost.

Conclusion: A Strategic Approach to Ownership

The 2025 BMW X5 promises an exhilarating driving experience, but it’s essential to approach the purchase with financial prudence. Understanding interest rates, exploring financing options, and considering other financial factors will ensure you embark on your ownership journey with confidence and financial security. By making informed decisions and leveraging available resources, you can navigate the road ahead with ease and enjoy the ultimate driving pleasure.