Navigating the Horizon: A Deep Dive into the FR 2025 Retirement Date Fund

The year 2025 is fast approaching, marking a significant milestone for individuals approaching retirement and those already navigating the complexities of their golden years. For many, the FR 2025 Retirement Date Fund stands as a beacon, offering a tailored investment strategy designed to help individuals achieve their financial goals in the twilight of their careers.

This article delves deep into the intricacies of the FR 2025 Retirement Date Fund, exploring its core principles, target audience, potential benefits, and the critical considerations that investors must navigate.

Understanding the FR 2025 Retirement Date Fund: A Primer

The FR 2025 Retirement Date Fund, often referred to as a target-date fund, is a mutual fund designed specifically for investors with a retirement horizon of 2025. Its unique structure and investment strategy aim to provide a balanced and diversified portfolio that evolves over time, adapting to the changing needs of investors as they approach retirement.

Key Features of the FR 2025 Retirement Date Fund:

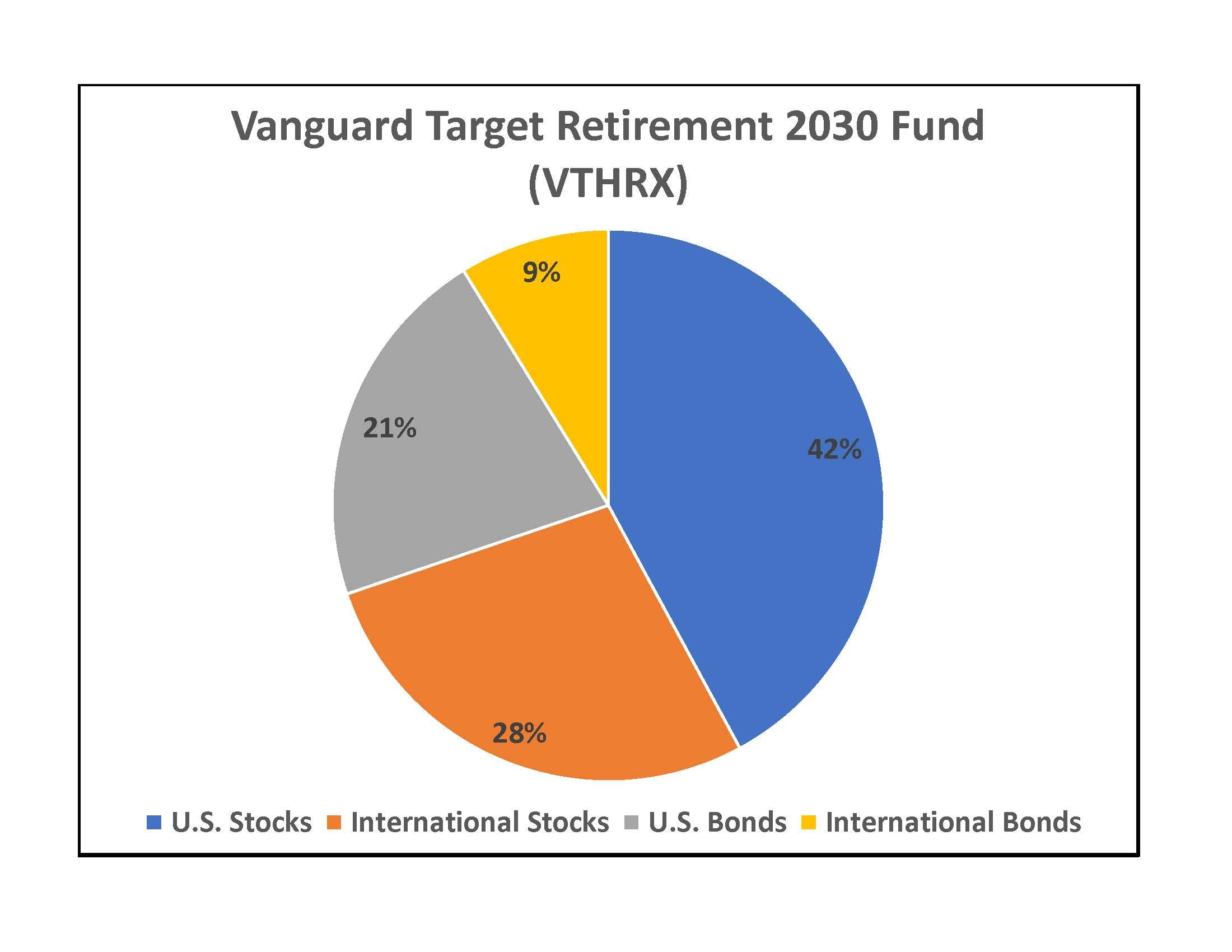

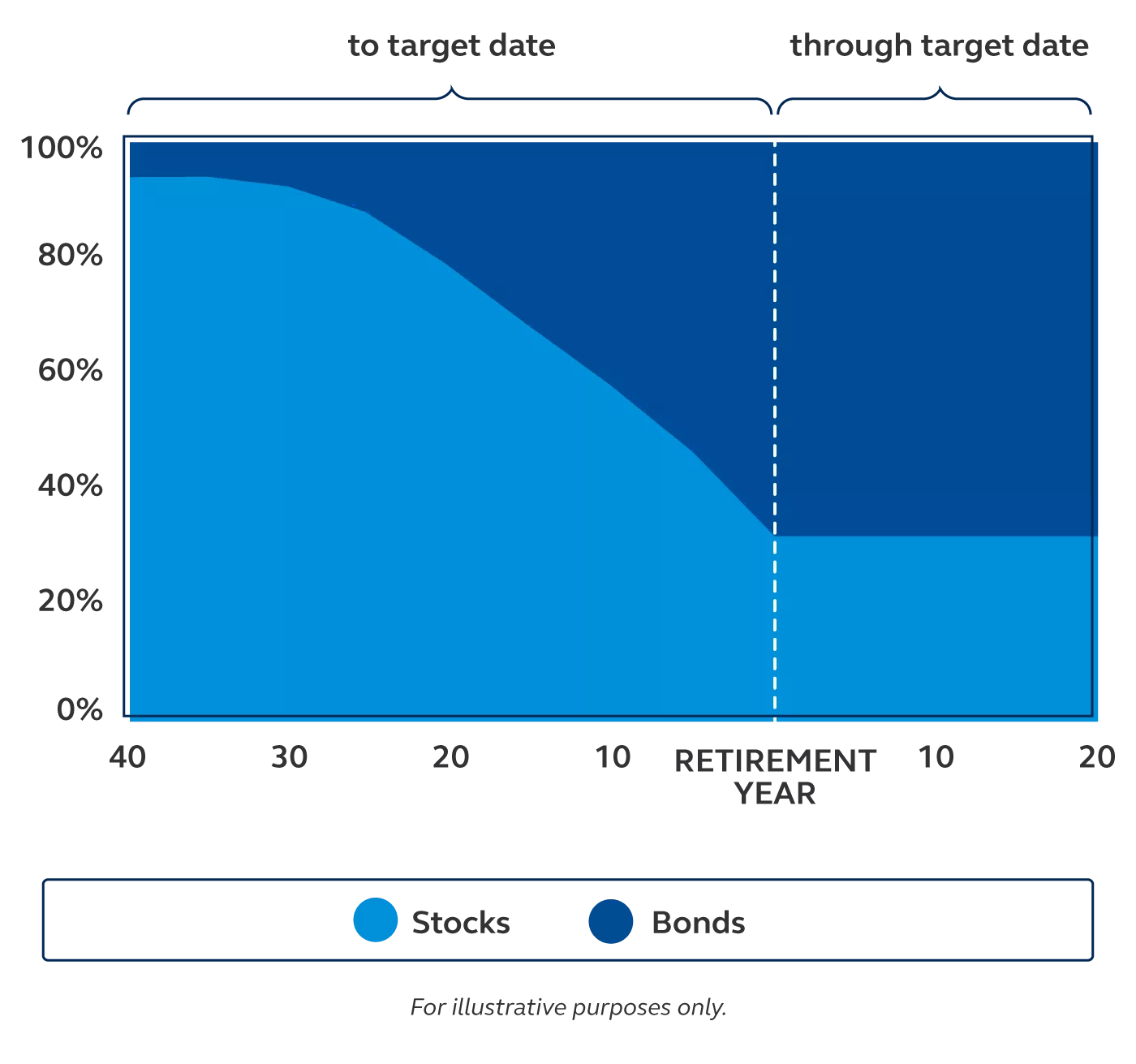

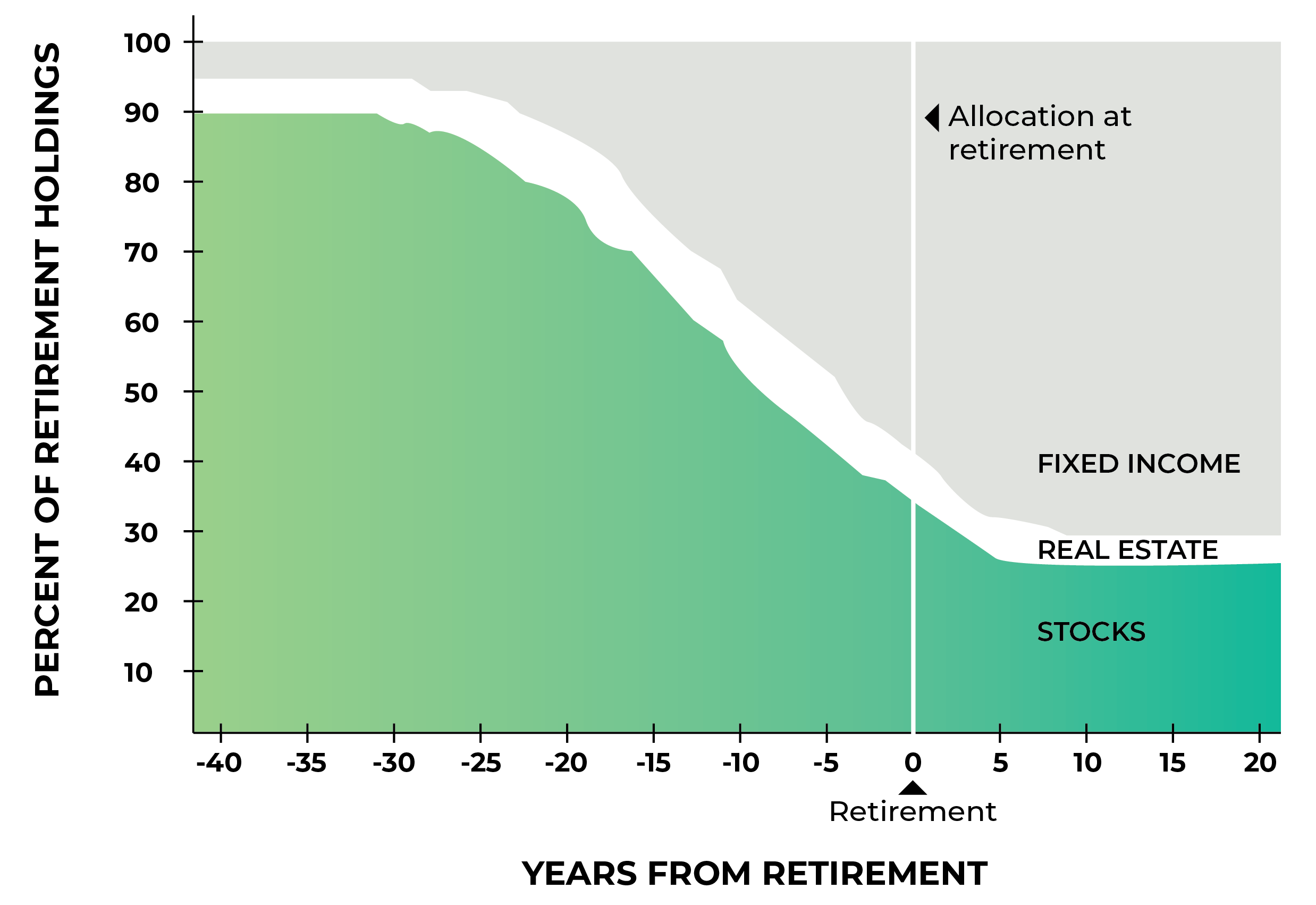

- Target-Date Approach: The fund’s core principle revolves around the concept of "glide path." As the retirement date approaches, the fund’s asset allocation automatically shifts from a higher allocation to stocks (equities) to a more conservative mix, including bonds and other fixed-income securities. This strategic shift aims to mitigate risk and preserve capital as retirement draws closer.

- Diversification: The FR 2025 Retirement Date Fund typically invests in a broad range of asset classes, including stocks, bonds, real estate, and commodities. This diversification helps to spread risk and reduce volatility, providing a more stable investment experience.

- Automatic Rebalancing: As market conditions fluctuate, the fund’s asset allocation is automatically adjusted to maintain the desired balance. This rebalancing process helps to ensure that the fund remains aligned with the investor’s risk tolerance and investment objectives.

- Professional Management: The FR 2025 Retirement Date Fund is managed by a team of experienced investment professionals who actively monitor market trends and make investment decisions on behalf of fundholders. This professional management provides investors with a level of expertise that may not be readily available to individual investors.

Who Should Consider the FR 2025 Retirement Date Fund?

The FR 2025 Retirement Date Fund is a compelling option for a variety of investors, but it’s particularly well-suited for individuals who:

- Are nearing retirement: Investors with a retirement horizon of 2025 or within a few years of that date will find the fund’s glide path and asset allocation strategy particularly relevant.

- Seek a hands-off approach: The fund’s automatic rebalancing and professional management relieve investors of the burden of constant monitoring and decision-making.

- Desire a diversified portfolio: The fund’s broad asset allocation provides a diversified investment strategy, helping to mitigate risk and promote long-term growth.

- Value convenience and simplicity: The FR 2025 Retirement Date Fund simplifies the investment process, offering a single point of entry for a comprehensive retirement portfolio.

Potential Benefits of Investing in the FR 2025 Retirement Date Fund:

- Risk Management: The fund’s glide path strategy effectively manages risk by shifting towards a more conservative asset allocation as retirement approaches. This helps to preserve capital and reduce the potential for significant losses in the years leading up to retirement.

- Diversification and Market Volatility: The fund’s diversified asset allocation helps to mitigate the impact of market volatility. By investing across a range of asset classes, the fund can potentially weather market downturns more effectively than a portfolio concentrated in a single asset class.

- Professional Expertise: The fund’s professional management team brings a wealth of experience and market knowledge to the table, providing investors with access to expertise that may not be readily available to individual investors.

- Convenience and Simplicity: The FR 2025 Retirement Date Fund offers a convenient and simplified investment solution for investors seeking a hands-off approach to retirement planning. The fund’s automatic rebalancing and professional management eliminate the need for constant monitoring and decision-making.

Critical Considerations for Investors:

While the FR 2025 Retirement Date Fund offers numerous benefits, it’s essential for investors to carefully consider the following factors before making a decision:

- Fees and Expenses: Like all mutual funds, the FR 2025 Retirement Date Fund carries fees and expenses that can impact returns. Investors should carefully review the fund’s prospectus to understand the associated costs and ensure they are comfortable with the fee structure.

- Performance: Past performance is not necessarily indicative of future results. Investors should review the fund’s historical performance data and compare it to similar funds to assess its track record and potential for future growth.

- Risk Tolerance: The fund’s asset allocation strategy is designed to manage risk, but it’s essential for investors to consider their own risk tolerance and investment objectives. The fund may not be suitable for all investors, particularly those with a high risk tolerance or a need for higher returns.

- Flexibility: While the fund’s glide path strategy is designed to adapt to the changing needs of investors as they approach retirement, it may not offer the same level of flexibility as a self-managed portfolio. Investors who prefer to have more control over their investment decisions may want to consider other options.

- Tax Implications: Investors should consider the tax implications of investing in the FR 2025 Retirement Date Fund. The fund’s distributions may be subject to capital gains taxes, which can impact overall returns.

Building a Comprehensive Retirement Plan:

The FR 2025 Retirement Date Fund can be a valuable component of a comprehensive retirement plan, but it’s not a one-size-fits-all solution. Investors should consider a multi-pronged approach that includes:

- Diversification: In addition to the FR 2025 Retirement Date Fund, investors may consider diversifying their retirement portfolio with other asset classes, such as real estate, precious metals, or alternative investments.

- Retirement Planning: Investors should consult with a financial advisor to develop a personalized retirement plan that takes into account their individual circumstances, goals, and risk tolerance.

- Estate Planning: As retirement approaches, investors should consider their estate planning needs and ensure their assets are distributed according to their wishes.

Conclusion:

The FR 2025 Retirement Date Fund offers a compelling investment strategy for individuals seeking a hands-off approach to retirement planning. Its glide path strategy, diversification, and professional management can help investors navigate the complexities of retirement investing and potentially achieve their financial goals. However, investors should carefully consider the fund’s fees, performance, risk tolerance, and flexibility before making a decision. By incorporating the FR 2025 Retirement Date Fund into a comprehensive retirement plan, investors can set themselves up for a secure and comfortable retirement.

Beyond the FR 2025 Retirement Date Fund: Expanding the Horizons

The FR 2025 Retirement Date Fund provides a valuable starting point for individuals approaching retirement, but it’s crucial to recognize that the investment landscape is vast and multifaceted.

Emerging Trends in Retirement Planning:

- Longevity Risk: Individuals are living longer than ever before, leading to concerns about outliving their retirement savings. This longevity risk necessitates a more comprehensive approach to retirement planning, including strategies to ensure income sustainability throughout retirement.

- Healthcare Costs: Rising healthcare costs represent a significant financial challenge for retirees. Investors should factor in healthcare expenses when planning for retirement and consider strategies such as health savings accounts (HSAs) or long-term care insurance.

- Social Security: Social Security remains a crucial source of income for many retirees. However, its long-term sustainability is uncertain. Investors should understand the potential impact of Social Security on their retirement plans and consider alternative sources of income.

- Retirement Lifestyle: Retirement is not simply about financial security; it’s about living a fulfilling and meaningful life. Investors should consider their desired retirement lifestyle and plan accordingly, factoring in travel, hobbies, and other activities that bring them joy.

Alternative Retirement Investment Strategies:

- Annuities: Annuities can provide guaranteed income streams in retirement, mitigating longevity risk.

- Real Estate: Real estate can offer both income and appreciation potential, but it also comes with significant risks.

- Alternative Investments: Alternative investments, such as private equity or hedge funds, can offer diversification and potentially higher returns, but they also carry higher risk.

The Importance of Financial Literacy:

Navigating the complexities of retirement planning requires a solid understanding of financial concepts and investment strategies. Individuals should prioritize financial literacy and seek out resources to enhance their knowledge and decision-making capabilities.

Embracing a Holistic Approach:

Retirement planning is not simply about investing; it’s about creating a holistic plan that encompasses financial security, health, and well-being. Individuals should consider all aspects of their retirement journey, including physical and mental health, social connections, and personal fulfillment.

Final Thoughts:

The FR 2025 Retirement Date Fund represents a valuable tool for individuals approaching retirement, but it’s just one piece of the puzzle. A successful retirement journey requires a comprehensive plan that addresses financial security, health, and personal well-being. By embracing a holistic approach and seeking guidance from qualified professionals, individuals can navigate the challenges of retirement and create a fulfilling and rewarding life beyond their working years.